With additional equity at home this year, I built up new courage to contact our lender, CBA, and request a much better offer. With little issues they decrease the speed of the 0.15%.

With an increase of equity at home this year, I gathered the newest courage to contact our very own financial, CBA, and request a far greater package. With little dilemma it dropped their price by 0.15%. I pointed out a far more enticing price in the an opponent having an effective $4,000 cashback offer, yet the best they may perform is a further 0.02%.

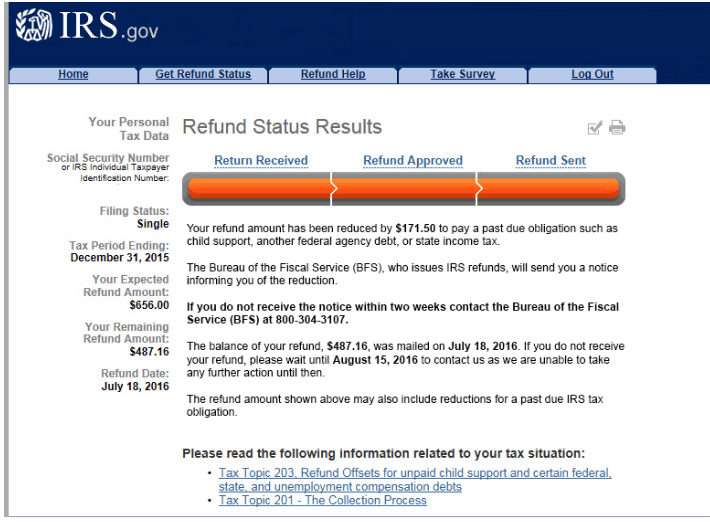

Therefore we already been the newest refinancing route. We politely shown i produced them alert to this before carefully deciding to follow the higher bring. Thanks for what you perform!

Also it cannot hold on there. Putting one $2,000 facing your loan is about to enjoys good compounding impact over the years, slashing the amount of time it needs that be financial obligation-totally free.

However, I would be inclined to bring at the very least a couple of hundred cash and also have an appreciation-pants https://elitecashadvance.com/personal-loans-in/ dinner. You need it!

My personal much time-suffering publisher, Wally, loves to laugh that you could tell new economic heart circulation of the country of a peek within my email. Whatsoever … lots of people of all ages, out of all over the nation, develop if you ask me in the what exactly is stressing them away.

My personal long-distress editor, Wally, wants to joke as you are able to tell brand new monetary heartbeat of the nation from a peek at my inbox. After all … lots of people of all ages, from all across the country, write to me from the what’s worrying them out.

The simple truth is. Nowadays the fresh new threat’ off rising rates of interest is at fever mountain. It’s been spurred towards because of the some pros forecasting you to rates often hit 3.5% by the the following year. To put that into the context … that will be 13 a lot more nature hikes in the nearly as much days.

But not, the new surging rising prices that’s taking place worldwide will demand higher interest levels in the years ahead … yet , We have little idea just how high they’ll wade, otherwise when.

New CBA has now open to dump our very own rates underneath the competitor rates and you will tossed inside the $2,000 from inside the cash to help you award united states for being a devoted buyers

My chief area is the fact highest rates of interest had been completely predictable – hell, I have already been talking about them for years! 5%, and additionally they limboed every thing ways as a result of 0.1%.

The one takeout about recent years is the fact the country try a dangerous and you may erratic set. Unusual stuff is when you the very least expect it. Crappy content goes for folks who have not available to they.

Better, if you’ve been adopting the Barefoot Strategies, the clear answer is actually: you may be currently carrying it out! You’re aggressively paying obligations, gathering a finances shield, and you may expenses future to the offers throughout your reasonable-costs, tax-active extremely funds.To put it differently, work with what you could control. So much more Big date Evening, quicker Television development.

We have found me personally: No you may not. Regardless of if pricing go lower a bit, you are firing in a newsprint purse with only 30% of your need-home left over.

Shortly after we had done a multitude of models by way of a broker, the family members from the CBA was indeed in contact asking why we wished to release our financing

Last Friday day I found myself with my kids regarding Lego store into the Melbourne while i got a text regarding a friend: Someone try impersonating you into Fb and you will powering a fraud in order to wool your readers!

Mention swinging regarding twigs! I’d recommend you possess an event inside the campfire and possess visitors first off pitching directly into let reduce that personal debt.