Planning get a good diamond-in-the-harsh and come up with it your own? Whether you are seeking to flip your domestic for money otherwise tends to make specific improvements to the enough time-name living space, it is critical to be in best psychology, take the appropriate steps and you will stay with it.

For almost all very first-time homebuyers, to shop for a fixer top will be an appealing solution whilst makes it possible for potentially pick a larger family during the a better location. The newest caveat are: performs should be done to convert it away from drab so you’re able to fab. Hence will cost you money and time.

Yet another residence is an enormous costs alone and you may incorporating to the renovations can also be stretch people budget for the restrict, particularly for very first-time homeowners. Before you make the fresh relocate to buy and remodel, it is advisable to speak through your financial support choices with a professional.

At the same time, that it useful guide commonly take you step-by-step through particular basic steps in order to realize and a few problems to stop since you changes the fixer top towards the family you have always wanted.

step one. Do: like a great venue.

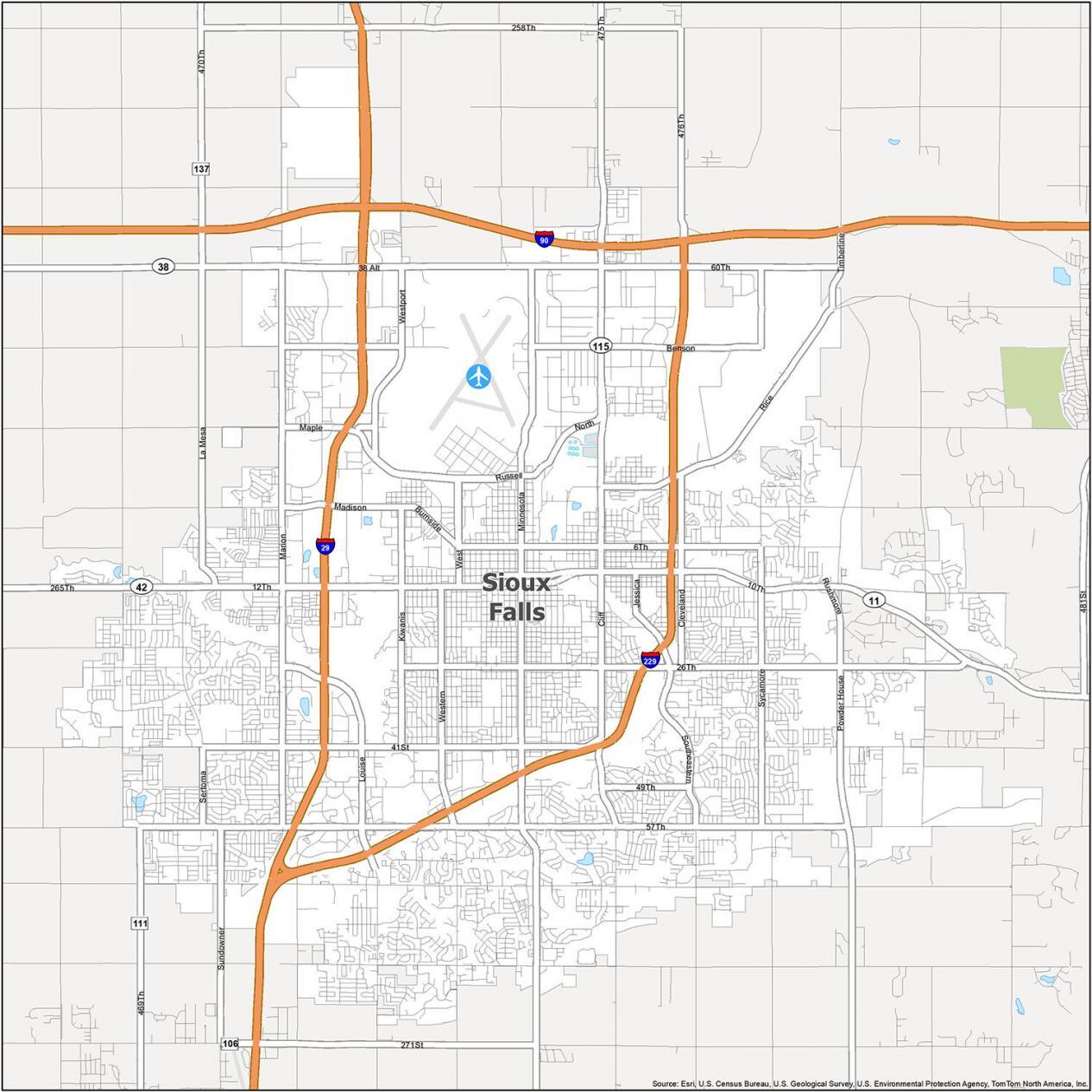

Your tune in to it out of real estate professionals all day – the most important factor when purchasing property is the location. If you find yourself to shop for an effective fixer-top, you will need to make sure your money of your property developments is actually worthwhile. When you find yourself there was specific debate whether buying the worst family on most useful neighbourhood’ is the way to go, whenever you pick a beneficial fixer-higher for the a good town which have in check improvements, it can prove to be a wise financial support.

You will want to online personal loans MI avoid purchasing a property with poor architectural ethics since the your home improvements may become a great deal more state-of-the-art and you will more than likely let you know some costly unexpected situations. You’ll be able to remember the Tom Hanks flick The bucks Pit’ where Hanks purchases a distressed residence which have the thought of restoring it so you can their previous grandeur. Unfortuitously, for every investment the guy begins suggests more performs that must definitely be done, and you may eventually the expenses snowball out of control. To avoid this, it is best to locate an examination over on your own assets and prevent house which have people telltale signs of poor architectural integrity, such sloping floors, cracks or leakage.

step three. Do: know when to call in a professional.

It will save you tons of money if you possibly could do your individual home improvements, however it is also essential to learn if it is for you personally to phone call when you look at the an expert. Effortless repairs that all individuals might possibly deal with is actually often points that try not too difficult, but just take time and effort. One of several trusted, that also will bring an effective go back try patching structure and you can color. Its unbelievable just how an innovative new finish away from paint commonly liven up a home. However when considering trickier operate like, electronic or plumbing, it’s best to leave it towards the advantages that will ensure that things are done securely considering code.

4. Don’t: spend some money instead a rising come back.

Whenever choosing the best places to purchase your money, think about what can truly add one particular to your selling value of your residence. Generally, upgrading kitchens and bathrooms will provide you with the best fuck for the dollar however, also, they are the costliest.

Certain simpler systems which also make you a good go back toward forget the were repainting, surroundings and enhancing the surface of your property. Together with think of strategies one to stretch your room, instance transforming vacant attic or basement room on the a supplementary room otherwise incorporating a patio from the backyard.

When you are curious what other Canadian property owners are trying to do: In the past seasons, outdoor systems provided how with 50% of your own home improvements, due to the fact bathrooms accounted for sixteen%, accompanied by cellar at the 10%, based on a beneficial Homestars Reno Declaration 2020.

5. Do: place a budget and try to stay with it.

Beforehand people do-it-yourself endeavor, you will want to earliest work out how much you really can afford to expend on renovations. After that speed your opportunity. If you are which have professional performs done, you need to score three estimates to help verify you’re getting a good rates. Together with, vet your designers, preferably, observe just what someone else are saying about their works. Upcoming, once you’ve the costs mapped away, be sure to has actually a little contingency currency reserved for any shocks. It’s also wise to make up delays once the they’ve been commonly unavoidable.

six. Don’t: cut sides when it comes to materials.

Before you can purchase content, first and foremost, size twice. It is very important ensure you acquisition the proper total end extra cost and effort after. Together with, avoid to shop for 2nd-rate product to save money. Although it ount in the short term, they could likely feel more pricey once they split otherwise require fixes otherwise repairs. Once you grab your own materials, it’s adviseable to scan all of them the faults. And it’s really a routine to find alot more material than just your you would like, and if.

eight. Do: try using how you can funds their renos.

Finally, it is time to decide the way to buy this new updates you are planning. If you possess the cash on-hand to purchase expenditures, without searching into the disaster loans, that is an excellent alternative.

If you are planning to order after that remodel, consider going your house upgrade will set you back to your overall financial number. This is entitled a buy Together with Improvements Home loan, and can make these types of big-violation expenditures so much more in check of the distribute all of them out to date.

If you’ve already ordered your property, property Equity Personal line of credit would-be for your requirements. It permits that borrow on the equity in your home. It is an exceptionally good choice if you’re planning on the flipping’ your home in the future, which makes it easier to invest right back your loan easily.

When you find yourself dealing with significant home improvements, it can be a smart idea to chat to an expert, who will walk you through your financing solutions and find the fresh new greatest services to suit your personal circumstances.