While employed, www.paydayloansconnecticut.com/new-preston the quantity might possibly be automatically deducted out of your income in the same date as the tax and you may National Insurance rates (NI). However, you may want to hang onto your payslips and you will P60 means, just like the you will have to write all of them if you ever request a good refund.

While from the Uk and you can swinging to another country, their education loan payments commonly nevertheless incorporate. The new fees tolerance alter depend on the country you reside for the, and you can should make direct repayments into Scholar Loans Providers (SLC). You will need to let them know of work info right that one can to make certain they generate the correct cost computations.

For college students out-of countries apart from the united kingdom, the rules may vary somewhat. Particular countries might have preparations positioned with the Uk otherwise various countries of education loan costs, but it is important to look at your certain disease.

Ideas on how to terminate student finance

When your plans changes through to the start of the the way, you could potentially amend or cancel your own resource software. You’ll have to get in touch with Pupil Finance The united kingdomt or even the relevant administering system to help you procedure so it.

Due to the fact basic label of college or university has started, because an entire-date student who typically resides in England, Wales otherwise North Ireland, possible remain liable for twenty five% of your tuition percentage mortgage even though you propose to withdraw, transfer otherwise suspend your own education at a later date. This percentage expands so you can 50% pursuing the first day of second title and 100% for people who start the next identity.

For people who typically inhabit Scotland, in which tuition costs is paid down straight to the newest college in a single instalment, and you decide to withdraw from the course before set big date, no university fees percentage loan would be repaid to you personally. After that day, the borrowed funds will be transferred to your path and college.

That have fix financing, possible getting accountable for per instalment the moment it’s paid down (at the outset of name). This consists of any attention accrued, in fact it is additional if you’re because of initiate your payments.

You need to speak to the relevant awarding human body, eg College student Fund The united kingdomt, prior to your choice. The reason being making your own way early can affect your chances from acquiring investment in future. Discover all of our suggestions about switching otherwise leaving the movement.

Difficulty money

- students to the a low income

- youngsters with people, particularly solitary mothers

- students before inside the care and attention

- disabled youngsters

- mature youngsters which have current economic responsibilities.

You’re able to find assistance from your university, including charity trusts. Non-repayable bursaries, scholarships and grants and you may prizes are around for children who had if not become unable to pay for to examine at that top. Contact your school to determine what’s available, whether you’re qualified and the ways to use.

Meanwhile, when you’re inside the economic complications immediately following your movement keeps started, their school might possibly offer money from their hardship loans to assist you. Use during your university’s help properties.

Pupil bank account

Really high-street banking companies keeps account aligned specifically on youngsters and you can it’s a good idea to start one of them before you start your own way.

Are approved having students savings account, you will have to have your university place verified – nevertheless when you’ve got the proof to show which, you need to use advantages prior to beginning your own way.

If you find yourself deciding and therefore lender to choose, don’t simply opt for the you to towards the better totally free provide. While bonuses eg beginner rail notes or any other coupons try constantly acceptance, the dimensions of the newest 0% overdraft studio have a tendency to prove to be a help when currency are strict.

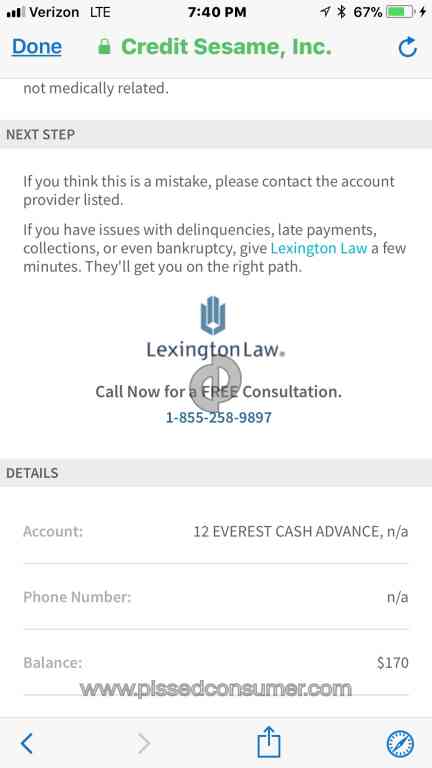

Be sure to keep yourself informed that student loan will in a roundabout way apply at your credit score, just like the student education loans commonly filed in your credit report. It indicates they don’t help or hinder your credit rating.

There is absolutely no penalty if you want to pay-off particular or all your amount borrowed outside this fees endurance. But not, when you have other financial needs, such as protecting to have in initial deposit into the property otherwise advancing years arrangements, you may want to want to prioritise those individuals earliest.