Combining obligations with a mortgage presenting a predetermined interest are a wise disperse and you can a good hedge up against inflation. For many years, many Americans are determined to save to their credit cards or other expenses because of the refinancing its financial and you may pulling out security.

Having ericans features looked to the mortgage in an effort to save money which have lower repayments from debt consolidating loan opportunities provided to homeowners within this country. People who possess a mortgage on the domestic found that the simplest way to combine debt is with a classic re-finance purchase.

See if Debt consolidation reduction Financing that have Mortgage refinancing Can help to save You Money with Lower Monthly payments and Quicker Interest levels Springfield pay day loan.

Merging debt can serve as an effective technique for managing and you will paying off multiple expenses efficiently of the combining them toward a single mortgage with a predetermined interest rate and you may a good good payment per month.

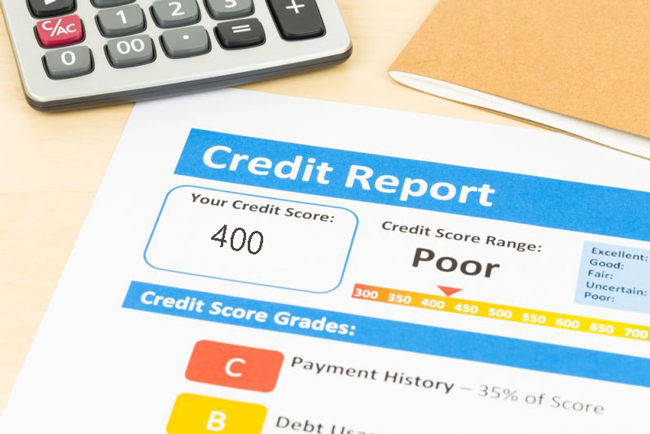

Regrettably, individuals that have below-average borrowing, defined as a get away from 640 or straight down, get stumble on demands whenever seeking to acceptance for the best debt consolidation finance.

Favorable consequences usually are on the borrowers possessing a robust credit character, watching best approval opportunity, and you can possibly securing much more beneficial conditions.

So, when you have a credit score a lot more than 640, preferably significantly more than 680, you will see a multitude of debt consolidation fund also mortgage refinancing and you can next mortgage loans.

eight Reasons to Get a debt consolidation Financing which have a mortgage

That is a great option for those who are trapped paying large attract loans expenses each month. For folks who aim to streamline your financial financial obligation stemming off borrowing from the bank notes or other money, a debt settlement financial might be the appropriate relocate to offer your money right back on track. When you find yourself contemplating mortgage refinancing so you’re able to consolidate their personal debt, consider these lots of benefits:

#1 Home loan Rates of interest Try Aggressive

Yes, interest rates was basically ascending, as numerous buyers accept that the fresh new housing and you can home loan business you can expect to heat up a lot more in the 2024. As the costs performed surge a bit, accredited individuals can always may a refinance loan mortgage during the the room out of six%. Believe refinancing their high interest levels with a predetermined speed financial obligation combination financing you to assurances a predetermined payment. Quite often, personal loans has highest rates than mortgages since they are unsecured.

For people who got your own home loan about ten years ago, you easily you’ll nevertheless be paying 5% or higher on your own home loan. Now is an enjoyable experience to help you re-finance in order to consolidate your debt, because you will most likely spend a much lower interest than what you’re purchasing to your handmade cards or pupil or personal finance.

You should be aware when the fresh discount really does warm up, interest levels will continue to increase. When this occurs, home loan prices is way too high and then make refinancing a great deal. Very, you can even act in the future. For individuals who have a low interest on the first financial, thought one minute mortgage having debt consolidation.

Some lenders offer type of annual payment rates. A low claimed home loan speed is not in hopes, along with your genuine refinance speed depends on your borrowing from the bank. Its necessary to receive a home loan price regarding debt consolidating lenders to select the interest you are paying prior to entry an application for a debt settlement financial.

#dos Build You to Monthly payment with debt Integration

When you yourself have credit card debt, you really provides numerous levels that you must pay each times. Purchasing numerous expense monthly try inconvenient. Along with, you run the risk from paying late using one of your own expenses and achieving a later part of the percentage.