Towards broadening land away from financial options during the Ontario, it’s necessary to see the different kinds of lenders open to prospective home owners.

Opting for anywhere between personal and antique mortgage brokers is a significant action in your go to homeownership. This short article give you a clear glance at both, so you can pick the solution that fits your needs better.

Do you know the Great things about Having fun with an exclusive Lender Compared to a traditional Mortgage lender?

Here’s the thing about private loan providers-they truly are versatile. In the event your borrowing score’s come on an effective rollercoaster trip, their salary is not necessarily the same month to month, or even in the event that bankruptcy’s a phrase in your immediate past, individual loan providers have there been to satisfy you your local area. They truly are all about wanting mortgage selection that fit your specific issues.

As there are another advantage-rate. Having shorter red-tape to help you browse, private loan providers often processes applications less than simply old-fashioned of these. Therefore, when the time’s of substance, supposed personal might get your one to mortgage recognition shorter.

Traditional loan providers, such as for example financial institutions and credit unions, commonly rather have individuals that have good credit ratings, secure revenues and you may a robust history of economic obligations. While this can be very theraputic for like anybody, it could prohibit individuals with financial hiccups. This is how personal loan providers are located in, connecting the pit and you can providing mortgage alternatives to possess a greater range away from borrowers.

What Standards Should one Envision When deciding on Ranging from Private Loan providers and you will Antique Mortgage brokers?

- Credit score: If you have a strong credit history, a vintage lender you are going to offer most readily useful interest levels. However, in case the credit score was sub-standard, a personal financial could be more likely to agree the home loan app.

- Earnings Balance: Antique lenders usually want proof of secure earnings. Concurrently, individual lenders are generally much more flexible and will manage notice-operating people otherwise people with changing income.

- Speed out of Approval: If you like quick recognition, private loan providers always processes software less than old-fashioned lenders.

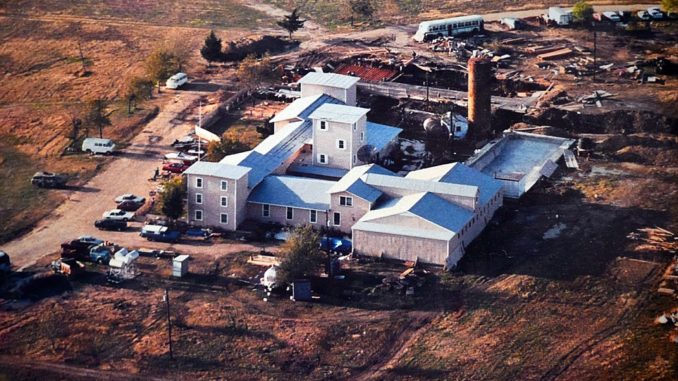

- Mortgage Goal: If you’re looking to purchase strange functions, like intense house otherwise commercial home, individual lenders would-be a whole lot more amenable.

Exactly what are the Main Differences between Individual and you will Conventional Mortgage lenders?

An important differences when considering individual and you may old-fashioned lenders revolve up to lending conditions, financing operating speed, liberty, and you will interest rates.

Old-fashioned lenders are often stricter from financing criteria, placing tall focus on credit scores and you can earnings balances. They may have expanded mortgage acceptance procedure using their rigorous bureaucratic formations. not, sometimes they provide all the way down interest levels to people whom meet its requirements.

Personal lenders do have another means. They are fundamentally a great deal more versatile making use of their standards, causing them to a spin-in order to in the event you may not match the traditional mildew. Price is even on their top – they often agree funds much faster.

Just what kits personal lenders apart is their concentrate on the property’s value unlike your credit history otherwise earnings. Inside a busy urban area, the loan Agent Shop will get give doing 75% of one’s property’s value, meaning you can acquire that loan of $750,000 on the a great $step one,000,000 assets. In quieter, outlying section, they typically provide up to 65% of the property’s really worth.

Is it Better to Qualify for a mortgage off an exclusive Financial than a vintage Financial?

Occasionally, yes, it can be more straightforward to be eligible for a home loan away from a beneficial personal lender. As they are quicker managed than conventional loan providers, personal loan providers convey more discernment inside their lending criteria, leading them to a viable choice for borrowers with exclusive economic things. They may be able research past credit ratings and you will money stability, focusing on the worth of the house or property rather. Providing you cannot meet or exceed the mortgage constraints to possess personal lenders (75% having metropolitan features, 65% to possess rural) you can get approved.

Although not, it is very important keep in mind that “easier” does not usually suggest “finest.” If you are individual loan providers may provide an even more available way to protecting a mortgage, they often times costs high interest levels to offset its exposure, that may result in large complete can cost you.

What are Reputable Individual Mortgage lenders?

- Research: Begin by a broad browse and you can restrict the choices established in your certain needs and activities.

- Product reviews and you may Reviews: Search for analysis and you can feedback from early in the day readers to judge their experience in the lender.

- Transparency: Reputable loan providers can be clear regarding their small print, fees, and you will rates of interest.

- Professionalism: A loan providers look after high conditions regarding professionalism, delivering obvious and you can punctual communication.

- Permits and you will Accreditations: Make sure the financial are authorized and you can qualified because of the related economic bodies.

- Consultation: Consult financial advisors otherwise experienced https://paydayloancolorado.net/heeney/ brokers discover specialist views and you can pointers.

Navigating this new terrain out-of financial financing can be advanced. The possibility anywhere between individual and conventional mortgage brokers would depend greatly on the your specific financial predicament and personal preferences. Old-fashioned lenders may offer lower rates and standardized credit choices, however their more strict conditions is limitation the means to access for almost all consumers. On the other hand, private loan providers also provide flexibility and you will rates however, often during the large rates.

In both cases, it is crucial to see the terms of the home loan contract thoroughly. And remember, smoother use of home loan acceptance doesn’t necessarily equal a much better economic decision. Always weigh the expense and you will benefits of for every solution carefully, guaranteeing the mortgage services aligns together with your long-label monetary needs.

For more information about individual mortgage lenders for the Ontario, you can visit the mortgage Agent Store site to possess in-depth insights and you may pointers.