It’s the best because you get to decide your worth (not management or HR)—and it’s the worst because you likely hate talking money with your clients. Accountants are professionals who have received an accounting degree, and some have tested to become certified professional accountants (CPAs). Regardless of certification, all educated accountants should be qualified to assist businesses and individuals with bookkeeping. Due to their advanced certification, CPAs may have higher rates. It’s similar to a fixed-fee model, in the sense that you have different prices for different services. But instead of a one-size-fits-all approach, you bill based on the perceived value to each of your clients.

How to Calculate Average Hourly Rates for Consulting Services

The types of services you offer—and how frequently you offer them—can heavily influence how much you charge. When marketing your accounting firm, remember to show off your experience and credentials to build trust and credibility. Your clients may also be willing to pay more if you have advanced degrees and certifications. These firms are at a tier below Big 4 firms, not necessarily in terms of knowledge base, but certainly in prestige, resources, and size. They range from international companies (like BDO or Grant Thorton) to national (like Crowe or BKD) or regional footprints (like Whitley Penn or Weaver).

Great! The Financial Professional Will Get Back To You Soon.

For most, this begins with earning a bachelor’s degree in accounting or a related field, such as finance or business administration. Conversely, respondents are less likely than they were last year to say their organizations consider workforce and labor displacement to be relevant risks and are not increasing efforts to mitigate them. Also, responses suggest that companies purchase discount in accounting are now using AI in more parts of the business. Half of respondents say their organizations have adopted AI in two or more business functions, up from less than a third of respondents in 2023 (Exhibit 2). Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

What’s Holding Consultants Back From Raising Their Fees

Whether you pay an accountant for a one-time service or hire someone as a full-time staff accountant, several factors will affect the cost of accounting services. Opportunities for accounting consultants are at an all-time high. Department of Labor’s Bureau of Labor Statistics, types of government budget the unemployment rate for accountants and auditors was 1.4% in the fourth quarter of 2019. A consulting gig is typically temporary, designed to help your client with a specific problem or situation, such as determining which entity type is the best for their new venture.

Do Consultants Offer Discounts?

You’ll need to consider factors directly affecting your business and the accountant’s services. Also, since consultants work with a variety of companies, often from an array of industries, they have a wide range of knowledge and skills that they bring to every project. In that sense, they can rely on a group of best practices collected from a diverse set of engagements. Consulting firms know that clients hire them because of their expertise, amongst other things.

What are the challenges of being an accountant consultant?

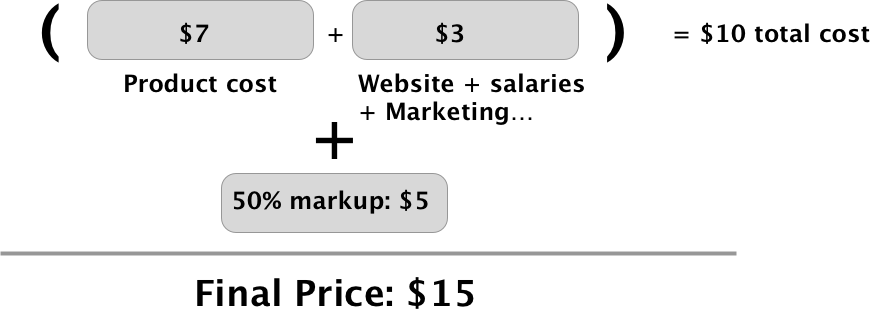

Then, mark that up 40%, which results in an hourly rate of about $40. The scope of work should be a large determinant of your rates, but pricing per hour or project is challenging to estimate. For example, it may be quicker for you to write a 2,000-word article for a company than to help produce a 5-minute podcast episode.

In AdvisoryHQ’s detailed review, we will be taking a look at the average accountant fees. The average cost of an accountant can encompass a significant range depending upon the location of the accountant, the services offered, and the fee structure each accountant chooses to implement. Hiring a reputable accounting professional will help keep you on track with all business payments, bookkeeping, cash flow, financial development, and business expenses. If you decide to DIY your own bookkeeping and accounting, the opportunity cost might be that you make a serious financial business mistake.

Read our white paper, How accountants work from home successfully, to discover specific steps you can take now, along with insights into how you can effectively manage your business remotely. Learn how to start an accounting advisory business in our white paper. No matter the timing of your transition to accounting consulting, you will need to plan your new business in advance. There may be additional training or education to help you specialize in a particular type of consulting, but there are also other considerations that require some forethought.

For instance, a firm could say they’ll bill for no less than six weeks for a project. However, if the job only takes three weeks, that clause means you’ll still pay for the six weeks of work, even though the consultants will already be heading off to their next engagement. Unfortunately, these extra bodies will add to the billable hours. Therefore, always read the fine print and look for these types of inclusions before signing that engagement letter, just to make sure you fully understand what you’re paying for. Finding a specific industry or service to specialize in can help set you apart in the market. Specializations can make your services more appealing to certain clients, often allowing you to command higher fees.

Some professionals also have certification from the IRS as an Enrolled Agent, which means they are expert on federal tax law. But there is nothing worse than setting a price too low and beginning to resent your work or your clients. Plus, with Karbon’s automated Client Requests and client portal, firms are saving 3.2 hours per week, per employee by not chasing clients for information. “Hourly arrangements can create a tense and antagonistic, ‘us vs. them’ relationship. Why would anyone want that with any vendor, let alone your accountant? The reason we do fixed pricing is because we don’t want our clients to be penalized for our incompetence and inefficiency, but we do want to be rewarded for our competence and efficiency.”

- Some clients will prefer to pay consultants per hour, while others may want to pay per project or retainer.

- For advanced-level accounting, finance and business systems roles, a master’s degree in business administration often goes hand-in-hand with a higher pay rate.

- Consulting firms, for the most part, have the agility that client companies lack, especially larger corporations.

- We suggest talking to a tax professional before going into the consulting world.

- Repeat this step and start scaling your rates up from there until you find a comfortable cost for your clients.

Passion, drive for excellence, leadership, communication skills, and organizational skills – in addition to your knowledge – play a big role in how successful you will be as an accounting consultant. While there are similarities, the primary difference between advisory services and accounting consulting is the length and purpose of the engagement. If you’re wondering how to transition into accounting consulting, you’re in good company. It’s fairly common for what is a schedule c irs form CPAs to become part-time or full-time consultants just prior to retirement, while others enjoy the benefits of greater flexibility and control over their schedules earlier in their careers. Another option is to consult on the side, or in between permanent jobs. Also, when setting an accountant’s fees, remember to calculate the time or money your company will spend on compiling documents, bookkeeping and running any software required to facilitate their job.

This type of advisory relationship differentiates you from other consultants. An accounting consultant can serve as both teacher and guide for a business, especially when the business could benefit from accounting services or improvements to their own accounting processes and procedures. Let’s examine the definition of accounting consulting and describe exactly what accounting consultants do, how to become an accounting consultant, why you should consider making the switch, and much more. As you can see, the average hourly rate varies widely by industry. However, the table provides a general idea of the ranges that can be expected.

They tell you that they wouldn’t have to stress about payroll and could enjoy working on things they really enjoyed. The intangible value is the project’s emotional and subjective factors that influence the buyer’s decision. The value conversation is where you ask questions to your client to uncover where they want to be — and agree on the value of a successful project.

Of course, one of the most significant differences between those solutions is their fees and hourly rates. And while we’re not here to tell you that one is better than the other, just a straightforward discussion of costs will go a long way in helping you decide which suits you best. Gen AI also is weaving its way into respondents’ personal lives. Compared with 2023, respondents are much more likely to be using gen AI at work and even more likely to be using gen AI both at work and in their personal lives (Exhibit 4). The survey finds upticks in gen AI use across all regions, with the largest increases in Asia–Pacific and Greater China. Respondents at the highest seniority levels, meanwhile, show larger jumps in the use of gen Al tools for work and outside of work compared with their midlevel-management peers.

This is the bread and butter pricing structure for the industry, including everyone from Big 4 and regional consulting firms to independent CPAs and bookkeepers. As you’ll see, there’s quite a range of hourly rates in each category, most of which stem from seniority. Put another way, the more senior the consultants working on the project, the higher the rate is going to be.